In This Edition…

- Legislature Approves Transportation Economic Assistance Grant Enhancement Bill

- Legislative Proposal Would Devalue Tax Incremental Financing

- Workforce Housing Legislative Initiatives Remain “Under Construction”

- Department of Revenue Unveils Business Development and Government Relations Unit

- Need a Speaker for an Upcoming Event? Connect with Badger Talks

- WEDA Supports Legislation to Boost Personal Property Aid and Workforce Housing

- WEDA Team Meets with New WEDC Secretary

Legislature Approves Transportation Economic Assistance Grant Enhancement Bill

Earlier this week, the Wisconsin Assembly passed SB 319, legislation to ensure the state’s Transportation Economic Assistance (TEA) Grant program provides grant funding for projects that retain jobs in Wisconsin. The bill had already been approved by the state Senate on Nov. 5.

The legislation, which is a top WEDA legislative priority, now heads to Gov. Tony Evers for his review – and hopefully his signature to enact the proposal into law.

The TEA Grant program, administered by the Wisconsin Department of Transportation (DOT), was created in 1987 to provide funding for transportation improvements critical to economic development projects that retain and create jobs in Wisconsin. The grants, available to businesses and communities, covers up to 50% of the total cost of the eligible transportation project. Recipients receive $5,000 per job created or retained by the project.

However, after an internal DOT review of the program several years ago, the Department determined it did not possess the statutory authority to provide grant funding for jobs retained – and going forward could only support projects that create new jobs. This change has diminished the value of TEA Grants as an economic development tool and is in direct conflict with Wisconsin’s growing workforce shortage. In short, it’s critical for state programs and policies to recognize that job retention is just as important as job creation.

Senate Bill 319 will restore the TEA Grant program’s long history of awarding project funds for both job creation and job retention.

The WEDA Government Affairs Team has asked Gov. Evers to sign the bill, and we remain optimistic it will become law by the end of the year.

Legislative Proposal Would Devalue Tax Incremental Financing

Legislation was recently proposed by Sen. Duey Stroebel (R-Saukville) and Rep. Jim Ott (R-Mequon) that would cap developer incentives for projects in tax incremental financing (TIF) districts. The proposal (LRB-4515), which WEDA strongly opposes, wiould significantly diminish the value of TIF, prevent key economic development projects across the state and put Wisconsin at a competitive disadvantage.

The 20 percent cap on developer incentives proposed by the yet-to-be introduced bill will restrict the flexibility needed by communities to take advantage of economic opportunities. In fact, there are many TIF-related projects across the state that would not have occurred and future projects that would likely not happen under the proposed legislation.

As economic development professionals across the state know all too well, TIF is essentially the only effective economic development tool available at the local level. Its success is directly linked to the authority it provides municipalities to address the needs of each individual project and to best serve the residents and business in their community.

Unfortunately, the proposed anti-TIF legislation would erode project flexibility and limit development opportunities. The bipartisan bill, which is supported by the Wisconsin Counties Association and Wisconsin Association of School Boards, would do the following:

- Limit the amount of cash grants to 20 percent of a TID’s total project costs. The cap would not apply if the development agreement specifies that the developer will finance the cost of public infrastructure improvements in the TID and will be reimbursed through cash grants.

- Require project plans adopted by a TID’s governing Joint Review Board (JRB) to include alternative economic projections to highlight the potential financial scenarios in the event of more modest economic growth.

- Clarify that a majority vote of the 5 member JRB is 3 affirmative votes. It also requires a unanimous JRB vote for the following:

- Project plan amendments to expand the territory of the TID.

- Project plan amendments to keep the TID open longer than authorized under the current approved project plan.

The WEDA Government Affairs Team is working with our strategic partners to oppose the legislation and has coordinated a grassroots advocacy effort to encourage WEDA members to effectively engage their legislators on this important issue.

Workforce Housing Legislative Initiatives Remain “Under Construction”

The last edition of Political News and Notes reported on the numerous legislative proposals aimed at increasing the development of workforce housing in Wisconsin.

The topic has quickly become a pressing issue in the State Capitol, as lawmakers have recognized how the severe housing shortage for people entering the workforce has hampered talent attraction efforts and threatens further economic growth in Wisconsin.

Among the legislative proposals being considered or developed by lawmakers include the WEDA-led initiative to create a sales tax exemption on construction materials and equipment used in the development of workforce housing, as well as proposals to spark new workforce housing construction through changes to TIF law. Other proposals include a workforce housing tax credit and a home rehabilitation tax credit.

For the latest information and status on workforce housing proposals working through the legislative process, please review WEDA’s Workforce Housing Legislation tracker.

Department of Revenue Unveils Business Development and Government Relations Unit

The Wisconsin Department of Revenue recently unveiled the Business Development and Government Relations (BDGR) unit, a new state program to assist Wisconsin’s small business community. The BDGR has a landing page to help businesses navigate state laws, regulations and programs to:

- Start or expand

- Recruit and retain employees

- Analyze economic data

- Identify tax incentives

The BDGR is also arranging quarterly Wisconsin Economics and Business (WEB) meetings around the state with the DOR Secretary, senior DOR economists and local economic development professionals. The format includes the latest business initiatives, presentations and data on the state and local economy, followed by a roundtable discussion. The presentations can be modified based on local interest, but often include:

- US Economic Forecast

- Wisconsin Economic Forecast

- Labor Markets: Labor Force Participation

- Housing: Workforce Housing Shortage

- Tax Revenues and Trends

- Entrepreneurship

“The Department of Revenue is uniquely positioned to assist Wisconsin businesses,” notes Department of Revenue Secretary Peter Barca. “We have contact with all businesses in the state through tax policy and administration. BDGR can connect businesses to resources and provide an ear for policy suggestions.”

Barca said the BDGR aims to provide businesses with access to the incentives, grants, permits, data, licenses and resources they need to grow and thrive.

For more information, you can visit the BDGR page on the DOR website. You can also contact the Department directly at BDGR@wisconsin.gov.

Need a Speaker for an Upcoming Event? Connect with Badger Talks

Invite UW–Madison experts to your next meeting or event!

Badger Talks boasts a roster of over 250 University of Wisconsin-Madison faculty, staff and graduate researchers who present around the state on hundreds of topics, including business, economics, engineering, leadership and sustainability.

- Venues include businesses, non-profits, agencies, organizations, and municipalities

- No cost to host a speaker

- Badger Talks helps coordinate speaker logistics and covers travel expenses

- Serving all Wisconsin locations

Interested? Request a speaker at badgertalks.wisc.edu.

WEDA Supports Legislation to Boost Personal Property Aid and Workforce Housing

The WEDA Legislative Committee met earlier this month for their 2019 fourth quarter meeting and discussed a number of pressing issues, including the status of WEDA’s legislative priorities, TIF-related proposals and recent legislative efforts to increase the development of workforce housing in Wisconsin.

The Committee also reviewed and voted to support the following two bills that were recently proposed in the Legislature:

- LRB-4540 – Personal Property Aid Payments: Under current law, certain machinery NOT used in manufacturing is exempt from the personal property tax. To hold municipalities and other taxing jurisdictions harmless, current law also provides them with state aid payments to compensate for the loss of personal property tax revenue. However, the Wisconsin Department of Revenue interprets current law to mean state aid payments made to a TIF district terminate when the TIF district closes. This bill would simply clarify that after the termination of a TIF district, the state aid payment is shifted to the other taxing jurisdictions.

- LRB-3862 – Home Rehabilitation Tax Credit: This legislation creates an individual income tax credit for expenses related to the rehabilitation of older single-family homes. The credit under the bill is equal to 10% of eligible home rehabilitation construction expenses. Individual tax credits cannot exceed $15,000. To be eligible for the tax credit: 1.) Initial construction of the home must have been completed before 1980; and 2.) The home must have a fair market value that does not exceed the county median price for single-family homes. In addition, the legislation requires tax credit claimants to be full-year residents of Wisconsin and specifies the rehabilitated home must be used as the claimant’s primary residence.

To follow all of WEDA’s activity under the Capitol dome, CLICK HERE to view our Legislative Tracker tool.

WEDA Team Meets with New WEDC Secretary

At the beginning of October, Missy Hughes began her new post as the Wisconsin Economic Development Corporation (WEDC) Secretary and CEO after being appointed by Gov. Tony Evers.

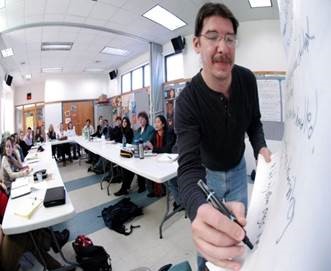

On her third day on the job, she attended and spoke at the 2019 WEDA Fall Conference. WEDA certainly appreciated her participation at the conference, and we were equally pleased when she agreed to meet with a WEDA delegation on Nov. 4 to discuss how WEDA and WEDC can continue its strong partnership to strengthen Wisconsin’s economy.

We had a productive conversation and appreciated Sec. Hughes comments on efforts to move WEDC forward and continue to provide businesses and communities with the tools needed to create new and exciting economic opportunities. We also valued her willingness to listen to our thoughts on how economic development policies and procedures can be improved at the state level.

We are confident the meeting is just the start of a continued dialogue with Sec. Hughes and her team at WEDC as they work to retain and attract businesses, create jobs and encourage economic growth in communities across the state.

At the conclusion of the meeting, the WEDA team also had an opportunity to briefly meet WEDC’s new deputy secretary and chief operating officer, Sam Rikkers. Rikkers, who will succeed Tricia Braun effective Nov. 15, had worked in the Obama Administration and most recently served as Gov. Tony Evers’ liaison on the Foxconn project.